Every business assumes the risk of non-payment when offering sales on credit. Bad debt expense (BDE) helps you record the impact uncollectible accounts have on your bottom line.

In this guide, you’ll learn what bad debt expense is, along with:

- How bad debt occurs

- The different methods of recording bad debts

- How to estimate BDE when using the allowance method (with examples)

- How collaborative AR minimizes bad debt

What Is Bad Debt Expense?

Bad debt expense, or BDE is an accounting entry that lists the dollar amount of receivables your company does not expect to collect. It reduces the receivables on your balance sheet. Accountants record bad debt as an expense under Sales, General, and Administrative expenses (SG&A) on the income statement.

Recording bad debt doesn’t mean you’ve lost that money forever. Companies retain the right to collect these receivables should conditions change.

You must record bad debt expenses only if you follow the accrual accounting system. If you follow the cash-based method of accounting, you’ll only record revenue once the payment physically arrives in your company’s bank account. If a sale on credit turns out to be uncollectible, in the cash method there isn’t a need to cancel out the receivable with the bad debt expense. This is because the revenue was never recognized in the first place.

In accrual accounting, companies recognize revenue before cash arrives in their accounts and must record expenses in the same accounting period the revenue originated.

This makes things difficult if months after making a sale on credit, a customer doesn’t pay their invoice. This is where the bad debt expense comes in. The bad debt expense reverses recorded revenue entries in subsequent accounting periods when receivables become uncollectible.

Why do bad debts happen?

Bad debt can happen for several reasons, some of the most common being:

- Disagreements—Customers are dissatisfied with your product or service quality and refuse to pay.

- Bankruptcy—Customers go bankrupt and cannot make payments.

- Poor communication—Sales teams offer credit terms without the accounts receivable (AR) department’s input, creating misunderstandings around payment terms.

The AR Disconnect is one of the leading causes of bad debts. It refers to the communication gap that arises between AR departments and their customers due to a lack of connected systems.

This miscommunication leads to AR teams being out of step with customer needs and expectations, often driving up bad debt.

When the billing and payment experience isn’t optimized, overall customer experience suffers. Wakefield Research and Versapay's survey on the state of digitization in B2B finance reveals the extent of this disconnect. Eighty-five percent of c-level executives surveyed said miscommunication between their AR department and a customer has resulted in the customer not paying in full.

Customers’ likelihood to short pay or skip paying altogether is deeply related to how you communicate with them throughout the billing and payment cycle. As we’ll discuss later, improving your customers’ experience is critical for minimizing bad debt.

Is Your Company Paying Too Much for Interchange Processing Fees? Then Learn how to

Lower Payment Processing Costs by Up to 40% with AR Automation

How To Record Bad Debt Expense

There are two ways to record bad debt expenses in your accounting statements.

These are:

- The direct write-off method

- The allowance method

Direct Write-Off Method

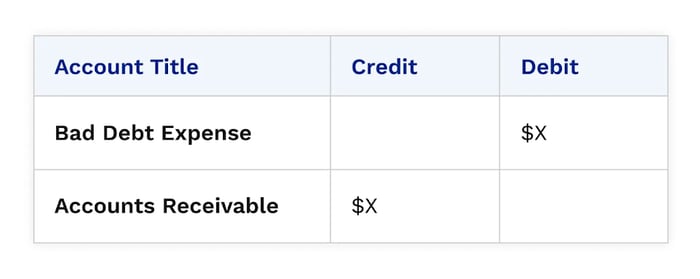

In the direct write-off method, you write off a portion of your receivable account as bad debt immediately when you determine an invoice to be uncollectible. You’ll debit bad debt expense and credit accounts receivable per the journal entry below.

Journal entry for bad debt using the direct write-off method.

This method is straightforward but might lead to confusing accounting entries. It can misstate income if your bad debt journal entry occurs in a different period from the sales entry. For that reason, the direct write-off method works best when recording immaterial debts or if you only have a few uncollected invoices.

Before you write off a debt, make sure to satisfy the IRS' conditions as follows (if your business is based in the US):

- You have firm evidence that your customer will not pay.

- You have taken reasonable steps to collect the amount owed, such as contacting the customer or addressing disputes.

Allowance Method

The allowance method is more complex on paper but paints a more accurate picture of your ability to collect invoices. According to the Generally Accepted Accounting Principles (GAAP), companies must follow this method due to the matching principle.

The matching principle states that companies must record all expenses and the revenue connected to them in the same period. Per the allowance method, companies create an allowance for doubtful accounts (AFDA) entry at the end of the fiscal year.

Here's a step-by-step overview of how recording bad debt via the allowance method works:

- Create an AFDA journal account.

- Estimate AFDA at the end of the accounting period. You can use one of the methods from the next section.

- Calculate actual bad debts.

- Record journal entries:

- Debit BDE and credit AFDA on the income statement

- Debit AFDA and credit AR on the accounts receivable balance sheet

How To Estimate Bad Debt Expense When Using the Allowance Method (examples included)

You can use one of three methods to estimate your allowance for doubtful accounts. These methods are:

- Percentage of sales

- Percentage of accounts receivable

- AR aging

Each of these methods relies on historical averages of your business’ collections. Basing your estimated uncollectible amount on historical probability makes sense when your business’ underlying conditions are stable. For instance:

- Your customer base is stable and has not changed significantly period-over-period.

- Your business is stable, having not experienced massive growths or declines.

- Economic conditions surrounding your industry are steady.

It’s also worth noting that your historical percentage of collections will likely vary between bullish and bearish economic cycles. If your company has enough business history to reference how collections performed in different economic cycles, this can be helpful for casting predictions.

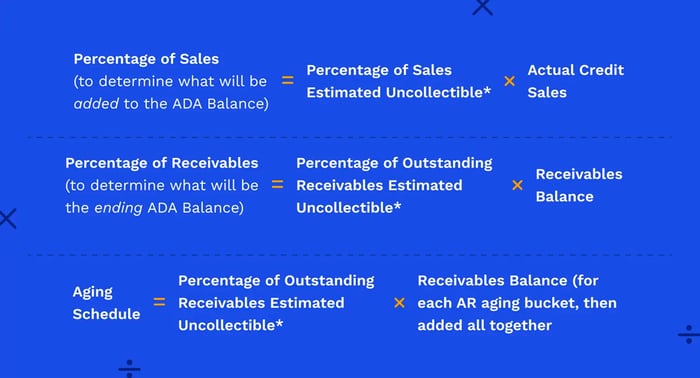

1. Percentage of Sales

Here’s the basic formula for estimating bad debt via the percentage of sales method:

Percentage of Sales Estimated Uncollectible X Actual Credit Sales = Bad Debt Expense

Here’s an example of how this would work:

- Historical average annual credit sales—$10,000,000

- Historical average uncollected credit sales—$500,000

- Historical percentage of uncollected credit sales—5%

You can use the 5% estimate to calculate the current period's bad debt allowance:

- Actual credit sales—$12,000,000

- BDE allowance—5% of actual credit sales = $600,000

Important distinction between this method and the percentage of receivables method

The result of your calculation in the percentage of sales method is your adjustment to the AFDA balance.

So, when recording allowance for doubtful accounts on the accounts receivable balance sheet, you’ll add any existing AFDA balance (from the year prior) to the adjustment balance to find the ending balance. When recording bad debt expense on the income statement, however, you’ll just record the adjustment value.

2. Percentage of Receivables

This method is similar to the percentage of sales method but uses AR instead of sales.

Here’s the basic formula for estimating bad debt via the percentage of receivables method:

Percentage Receivables Estimated Uncollectible X Receivables Balance = Bad Debt Expense

Accounts receivable is a permanent asset account (a balance sheet item) while sales is a revenue account (an income statement item) that resets every year. As a result, the steps you’ll take to estimate your AFDA in this method are different compared to the percentage of sales method.

Here’s an example that illustrates these changes:

- Historical average accounts receivable—$15,000,000

- Historical cash collected from accounts receivable—$1,200,000

- Historical percentage of uncollected receivables—8%

You can use the 8% estimate to calculate the current period's bad debt allowance:

- Receivables balance—$18,000,000

- BDE allowance—8% of receivables balance = $1,440,000

Important distinction between this method and the percentage of sales method

The result from your calculation in the percentage of receivables method is your company’s ending AFDA balance for the end of the period. This is because any overdue receivables from the year prior are already accounted for in the receivables balance for the current period.

The result of your calculation is what you’ll record on the accounts receivable balance sheet. When recording bad debt expense on the income statement, however, you’ll just record the adjustment value. The adjustment value is the difference between the ending AFDA balance and the starting AFDA balance.

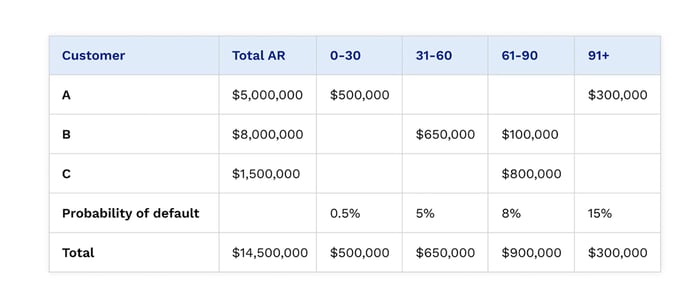

3. Accounts Receivable Aging

The accounts receivable aging method is a subset of the percentage of receivables method. Here instead of using one average value to determine your percentage of uncollectible receivables, you’ll assign a collection probability to each of your AR aging categories.

You’ll calculate your bad debt allowance for each aging bucket then add these totals all together to find your ending balance.

For this method, you’ll first need to create an AR aging report.

Here's an example of an AR aging report with collection probabilities that add up to a total bad debt reserve.

The accounts receivable aging method offers an advantage because it gives AR teams a more exact basis for estimating their uncollectibles. The final collection probability is however still an average and individual outstanding accounts could skew calculations. For instance, Customer A might routinely clear 100% of bills within 30-60 days, but Customer B might have a tendency to default.

The accounts receivable aging method offers an advantage because it gives AR teams a more exact basis for estimating their uncollectibles. The final collection probability is however still an average and individual outstanding accounts could skew calculations. For instance, Customer A might routinely clear 100% of bills within 30-60 days, but Customer B might have a tendency to default.

Here's an overview of how to calculate bad debt expenses using all three methods we’ve discussed:

*Based on data from previous years

You can use any method to record bad debt, as long as you remain consistent from year to year (and disclose that you’ve changed methods if that’s the case).

How Collaborative AR Minimizes Bad Debt Expense

Bad debt expenses, if they get out of control, can significantly impact your profits.

The good news is you can minimize bad debts by optimizing the way you manage your collections.

A collaborative accounts receivable solution—such as Versapay—uses automation and cloud-based collaboration technology to get customers, sales, and AR on the same page.

It creates greater efficiencies, accelerates cash flow, and drastically improves the customer experience.

Here are three ways collaborative AR minimizes bad debt expense:

1. More Transparent Lines of Communication With Customers

Collaborative AR makes it easier for your AR staff to communicate with customers to clear up issues that often lead to payment delays, such as disputed invoice charges or missing remittance information. Instead of sifting through multiple email threads, AR staff and customers alike can find all the information they need in one place.

When handling disputes, AR teams can seamlessly loop in necessary team members to ease customer communication and tap into shared knowledge faster. Customers also receive full visibility into their outstanding balances and can seamlessly make payments through a cloud-based self-service portal.

This minimizes disputes and creates more transparent credit policies, removing barriers preventing customers from paying on time.

2. Better Alignment Between Sales and AR Teams

With collaborative AR, you can ease communication with not only customers but also members of your sales team. Giving Sales access to customer payment history and cash flow data also helps them make more informed credit decisions.

For example, by making it easier for Sales to access data on which customers are paying on time, late, and severely late, they can use it when negotiating credit terms with a customer.

Better lines of communication between sales and AR departments also ensure there are no misunderstandings about the credit terms and early payment incentives Sales is allowed to offer.

The result is credit cycles that benefit customers and your organization.

3. Greater Focus on Value-Added Work

A collaborative AR tool like Versapay combines cloud-based collaboration features with what you’d expect from a first-rate accounts receivable automation solution. In addition to streamlining internal and external communications, AR teams can automate their invoicing, collections, payment processing, and cash application workflows.

Automating these tasks frees your AR team to focus on executing more strategic, value-added work. Team members can focus their attention on uncovering the causes of payment delays and working with customers to better understand their needs.

Not only does this help forge better customer relationships, but it also minimizes bad debt expense by reducing the likelihood of receivables becoming uncollectible.

—

Bad debt expense helps you quantify lost receivables and measure collection effectiveness. BDE is also a measure of the quality of your overall customer experience since healthy customer relationships mean fewer disputes and uncollected invoices.

Learn how Versapay’s collaborative AR software minimizes your company’s bad debt expenses by streamlining collections and avoiding miscommunications that often lead to late payments.