What Do You Do When a Customer Wants to Increase Their Credit Limit?

If a client wants to increase their credit limit because of growing demand, consider using Customer Entry Statistics in Microsoft Dynamics 365 Business Central (NAV) to determine their creditworthiness.

How to use Customer Entry Statistics

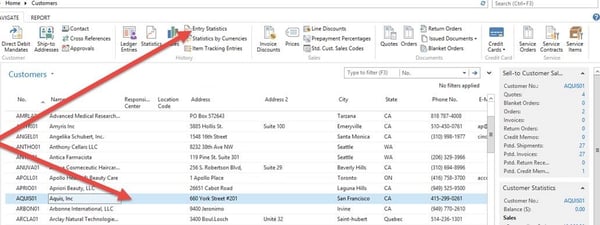

The Customer Entry Statistics window can be seen from the customer list by selecting a customer, going to History on the Ribbon, and then clicking Entry Statistics:

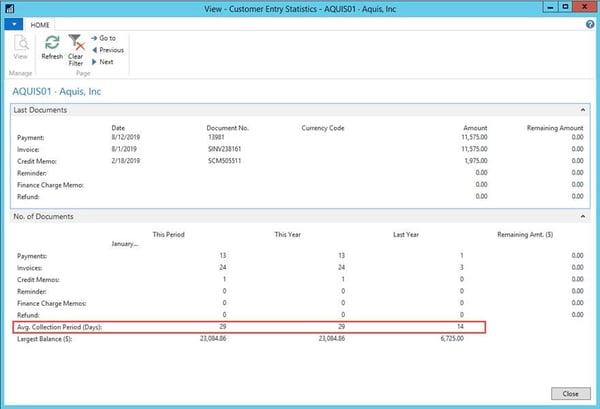

This window displays statistics for customer ledger entries.

The No. of Documents that FastTab shows correlates with the number of entries of each document type, for:

- the Current Accounting Period.

- the Current Year to Date.

- the Preceding Year.

It also shows the total remaining dollar amounts for all entries of each type.

Let Business Central Reveal how Creditworthy your Customer is!

At the bottom of the FastTab, the program has calculated the Avg. Collection Period (Days) for each period. This is determined by subtracting the posting dates from the corresponding payment dates and dividing the total by the number of invoices. This would be good for reviewing a customer’s request for a different payment term or even a credit limit. The customer's largest balance (in $) in each of the three periods is also shown.

This blog is part of an ongoing series about Customer Care. Please click on the image below to access the other entries in this blog series.