In just the initial months of the COVID-19 pandemic, digitization efforts within companies accelerated by an astounding seven years. With their backs against the wall, business leaders were ready to embrace technologies at a rate faster than ever before.

We see this in the business-to-business (B2B) payments world too. Previously hesitant finance leaders have now adapted their systems to accept a larger share of digital payments and maintain business continuity while their employees worked from home.

Entering 2022, B2B finance leaders and payment solution providers will continue to digitize processes long mired by inefficient manual practices. They’ll also prioritize building deeper integrations between systems and eliminating hang-ups that have long troubled the B2B payment experience.

In this blog, we’ll break down six top B2B payment trends to look out for in 2022

1. AR and AP departments will be quicker to embrace automation

The last two years saw finance and accounting departments shift significantly away from manual and paper-based processes in favor of acquiring digital tools. The speed with which companies are making the shift, however, has surpassed even our own expectations.

In September 2020, a PYMNTS survey found that 70% of B2B firms were planning to implement some level of technology to manage their accounts receivable (AR) processes over the course of the next three years.

By June of 2021, however, this timeline had vastly accelerated. Our survey of 400 CFOs at companies with at least $25 million in revenue found that 93% of respondents were already integrating technologies into their accounting operations. Of the remaining meager 7%, nearly half of them reported that they planned to digitize their accounting functions in the next twelve months.

While initially driven by the necessity of pivoting operations for a pandemic marketplace, the speed with which B2B finance and accounting leaders are embracing payments technology reflects a very real change in mindset. This new outlook will carry finance leaders forward in 2022 as they automate areas of the invoice to cash process that they had not previously considered.

The top areas within accounts receivable and accounts payable (AP) that CFOs are focused on streamlining look to be:

- Invoicing customers or vendors (currently being digitized by 61% of CFOs)

- Payment processing (currently being digitized by 51% of CFOs)

- Tracking payments received and due (currently being digitized by 48% of CFOs)

2. Deeper integration between AR and AP vendors to combat portal fatigue

With the proliferation of all these accounts receivable and accounts payable (AP) technologies, however, comes an additional challenge.

B2B suppliers often request that buyers pay them through their dedicated AR automation portals. Conversely, many B2B buyers (especially of the mid-size and enterprise varieties) will request that their suppliers log into their dedicated AP automation portals to collect payment (such as virtual cards) and find the associated remittance information.

For buyers and sellers alike, this means having to manage multiple portal logins and keep track of payment information in multiple locations, leading to what’s known as portal fatigue.

Many buyers (especially if they have the leverage of being a larger company) will simply not use their supplier’s payment portal. Instead, they’ll send payment through their preferred channels. This makes it exceptionally challenging for the supplier’s AR team to issue invoices and reconcile payments for those customers, as they must do so outside of their automated environments.

When we rolled out Versapay, we knew that some of our larger tenants might not pay through the platform. We still have folks who prefer to receive a PDF invoice outside of the system.

— Jeff Phaneuf, VP of Finance and Planning, Boston Properties

To solve this challenge, more AR and AP automation software vendors are working together to build stronger integrations between their platforms.

Increased connectivity of AR and AP systems is a motivating factor for many businesses when digitizing their payments operations in the first place, cited by 83% of CFOs. With software buyers actively seeking out these integrations, establishing strategic partnerships will be top of mind for AR and AP vendors in 2022.

3. The network of networks will take effect

The lack of common systems between AR and AP departments makes the B2B payment experience often feel frustrating, disconnected, and broken for both buyers and suppliers.

Financial institutions and card networks are attuned to this and have begun to build B2B payment networks in efforts to streamline the way companies send invoices and payments to one another. For example, there’s Visa’s B2B Connect, which focuses on simplifying the processing of cross-border payments. There’s also the US Federal Reserve’s efforts to streamline businesses’ sharing of electronic invoices and remittance information.

“Buyers work with a lot of suppliers. Suppliers work with lots and lots of customers. It’s ridiculous to think that they’re all going to use the same B2B network,” says Erin McCune, a partner, and payments analyst at Glenbrook Partners LLC. “So, this phenomenon is really intensifying and creating a lot of inherent efficiencies because it drives a sort of network of networks effect.”

As businesses increasingly transact with customers and vendors through AR and AP automation solutions, these platforms will become networks in and of themselves. And with further connectivity between them, what we’ll see is this network of networks take shape.

When you think about the consumer side of things, there are so many examples of digital marketplaces. We think over time we’ll see more of this in B2B. Buyers will be able to get online, and through the systems they're using, get connectivity with the vendors they serve—or vice versa. Individuals in the AP and AR department, in sales, in service, and elsewhere, will be able to collaborate and see what their peers have said and done for that customer or with that supplier.

— Craig O’Neill, CEO, Versapay

4. Customer experience will be front and center in AR processes

In addition to improving integrations between AR and AP systems, another priority—an arguably more important one—for finance leaders in 2022 will be to improve the way the people behind those systems collaborate. This includes buyers (AP teams), suppliers (AR teams), internal sales teams, and even customer success teams.

The invoice to cash process traditionally gives B2B buyers and suppliers minimal visibility into the status of outstanding payments. Buyers don’t have easy ways of knowing what they owe and what credits they have available. Similarly, suppliers don’t have easy ways of knowing if buyers are working on sending payment. With few ways to communicate with one another apart from cumbersome emails and phone calls, requesting simple clarification on an invoice can lead to significant payment delays.

But, research suggests finance leaders are actively prioritizing customer experience in their pursuit of accounting digitization. When asked in a survey why they were digitizing their AR and AP workflows, 96% of CFOs said it was to benefit their customers and vendors. 70% of them also reported that they believed digitizing their AR functions would be vital to building lifetime customer value.

For the many accounting departments that will be bringing automation into their operations for the first time, tools that prioritize customer collaboration will be top of mind.

5. Using AI to improve back-office accounting processes

For payments that businesses must receive outside of their dedicated AR automation system, all is not lost. Some accounts receivable automation vendors have layered artificial intelligence into their offerings to assist AR staff in compiling remittance information and matching it with open receivables automatically.

Back-office accounting processes such as cash applications are the perfect candidate for artificial intelligence, as they typically revolve around repetitive tasks and situations that a machine-based logic can be applied to relatively easily.

In our recent webinar hosted with The Association of International Certified Professional Accountants (AICPA), Dr. Al Naqvi, CEO and Professor at the American Institute of Artificial Intelligence, described how the period of AI advancements from 2011 to the present can be described as “The AI Revolution.”

AI use will only increase, and so entire industries and sectors are now emerging as clusters of AI expertise and capability. When a technological revolution happens, the nature of a profession and the way we complete tasks changes. In the 1980s and 90s, many accountants used their skills to design and implement enterprise resource planning (ERP) systems. In the same way, AI-enabled finance and accounts receivable professionals is where we’re going.

— Al Naqvi, CEO and Professor, American Institute of Artificial Intelligence

6. The rise of ecommerce, virtual cards, and buy now, pay later (BNPL)

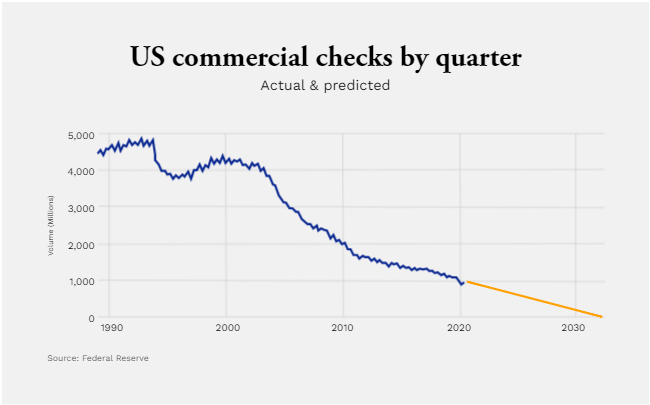

As B2B check use continued its steady decline in 2021, this paved the way for greater adoption of newer and emerging payment methods among business buyers.

In Q1 of 2021, commercial check usage in the US fell to an all-time low, with the Federal Reserve reporting 901 million checks collected. While 901 million sounds significant, it’s marginal compared to the 4+ billion checks collected in the same quarter of the year 2000.

The same survey of 400 CFOs mentioned earlier found that accounting departments with digitized AR and AP functions have reduced their reliance on paper checks. Forty percent of CFOs reported that they use checks less frequently as a result of digitization brought on by the pandemic.

Meanwhile, businesses’ use of digital payment methods has gone up. Fifty-five percent of CFOs say they use virtual cards more frequently since the onset of the pandemic. Regular ACH and credit cards saw an increase in use as reported by 68% and 64% of CFOs respectively.

Business buyers’ growing interest in consumer-centric payments methods is expected to continue well into 2022, as well.

ECommerce experienced a boom during the onset and late stages of the pandemic, and B2B was no exception. In 2021, B2B eCommerce sales grew by 17%, reaching over $1.58 trillion USD. B2B eCommerce sales are projected to grow an additional 12% in 2022, reaching $1.77 trillion.

Installment payments like buy now, pay later (BNPL) are also gaining interest, with payment card networks partnering with financial institutions and fintechs to fuel the expansion of BNPL in B2B payments.

With more B2B finance leaders buying into the value of accounting digitization, their opportunity in 2022 will be to enhance the maturity of their systems with greater integrations (between AR and AP automation platforms and ERP systems) and greater collaboration with their customers.